You may have heard that buying gold is one of the most rewarding activities one can take part in as far as retaining wealth over the long-term. Even before pirates were stealing gold doubloons to the ancient Egyptians love of gold. Gold has been the one of the true sources of wealth throughout the ages.

There is no doubt that the rewards for holding gold as a flight to safety during volatile economic times. But, of course, you’d have to put yourself in a position where you can do the right things in the market at the right time. To do that, there are a few things that you have to consider first.

Why Do People Trade in Gold?

As one of the higher-valued elements out there, Gold is considered to be a sought-after material. According to the World Gold Council “Its price has increased by an average of 10% per year since 1971 when gold began to be freely traded following the collapse of Bretton Woods.” As such, there are quite a lot of people, pension funds, institutional investors and governments who would want to keep a holding of their portfolio invested in gold.

As for the reasons why they would invest in gold, there are many but they often fall under the following:

1. Inflation Hedge

It goes without saying that economies are rather infamous for their fickleness to the point of unpredictability. The crash of the US economy in 2008 is proof of that along with the potential economic fallout from the worldwide COVID-19 pandemic.

And whenever something as big as the US economy fails, the fallout will spill into other countries that have traded with America. Central banks would then have to lower their interest rates and money supply increases to stem the tide; And if these do fail, inflation typically follows.

But the value of gold has maintained strong purchasing power regardless of inflation unlike fiat currencies. As such, it provides for a stable shield for your money in case the worst comes for the economy.

2. Shield Against Global Instability

Gold is not only a protection for your money during economic crises. The truth is that the metal is known to perform particularly well when the world is under extremely turbulent times. This includes wars, terror attacks, and, recently, global pandemics.

Even while other industries and businesses are suffering from major closures and lock downs due to the Coronavirus, gold has maintained a strong and stable performance against various stock markets. The gold price may rise and fall with trends in the short-term but the drops are not so drastic so as to ensure an upward return over the long-term.

To say it alternatively, gold generally performs well as a commodity even as other items and industries drop in the face of massive catastrophes.

3. Demand Speculation

Investors are also basing their investment options on the optimistic trends shown by economies under favorable times. Back in the late 2010s, China and India had rather strong economic performances and people saw investing in gold as a way to indirectly profit from these trends.

It also does not help that gold has played a crucial role in the development of economic superpowers like China, India, the US, and Russia. Their wealth will always translate into an increase in demand for gold which increase the price of gold.

4. Portfolio Diversification

It has often been recommended that investors diversify their investment portfolio so if one asset class falls it might not affect the entire investment holding. That means that they should not stick to one type of investment or commodity if they want to optimize their return of investments.

Gold has always been seen as a great mainstay of an asset class that could balance out all of an investor’s investment options. Also, Gold has a low correlation to several classes of assets which further makes it an even more attractive item to invest in and diversify your investment portfolio with.

How Does Gold Investment Work?

For something as seemingly static-looking as gold, there are actually several ways to invest on it. Regardless of your strategy and your investment philosophy, gold investments follow an upward pattern which goes as follows:

- 1Insurance - This comes in the form of gold bars and bullion that you possess or have listed on your portfolio.

- 2Investment/Saving - If you deposited that gold into a bank, it becomes a savings option for you. This tier also includes gold certificates, and other accounts with allocated gold.

- 3Investment - This tier will involve investing in shares at gold mining companies or gold manufacturers. Gold ETFs will also be included here as well.

- 4Speculation - This final tier will involve the search, identification, and procurement of new gold sources. As such, what is included here are Gold CFDs, shares in gold exploration ventures, gold futures, and other gold options.

This pattern also follows an increasing level of risk with speculation being the riskiest and insurance the safest. You could see that your level of physical ownership decreases with the tiers. In essence, tier 1 involves the gold that you currently have while tier 4 involves gold that you have yet to see, let alone own.

This also means that pricing for gold investments differ depending on their liquidity. For example, speculation tends to fluctuate while the gold price and for other types of bullion follow a relatively manageable range.

So, Should You Invest in Gold?

What you have to understand is that, just like with any investment, gold has its own set of risks and rewards. As was stated, the price of gold has followed a stable pattern even in the face of massive geopolitical changes. As such, given what we heard about thus far it does seem that serious investors should be considering even small portions of gold in their investment portfolios.

Also, in as much as it remains stable as an investment even with the prospect of worldwide instability, it also provides investors with a way to capitalise on the strength from developing economies. These economies are no stranger to turmoil and thus are not that trusting with fiat currencies than stable economies.

So, as wealth grows in these countries, so too will the demand for it which increases the gold price along with any other market. As such, if you want to take advantage and get exposed to upwards economic trends worldwide but without having to invest in local stocks and bonds, gold is the way to go.

But all of these advantages are offset by glaring risks. Remember that gold might affect economies but itself is economically dependent depending on whose countries it originates from.

For instance, the central banks in US, China, and India are known for their aggressive policies which could lead to significant price drops in gold. This could result in a slowdown in sales of gold reserves which, in turn, further cause prices to lower.

And, most important of all, the price of gold is as much as dependent on trends in the market as much as it dictates the same. If ever opinion towards the element turns bad, prices will lower.

As such, the rule of thumb when investing in high-valued commodities like gold is always this:

Never invest in what you cannot afford to lose

Investing in Gold Bars

As was previously stated, gold can take on several forms. This means that there are several ways to invest in it, each with their own set of rewards and risks.

One of the better ways to speculate on gold is to hold the actual commodity in the form of bars and coins. However, as this is the most direct way of investing on gold, gold bullion must be stored in a secure storage facility.

But one thing you should consider with the price of gold is that it involves more than the metal’s intrinsic value. Aside from the prospect that this leaves the material ever exposed to security threats, storing gold bullion in a secure facility is an expensive activity. After all, making sure that all of that physical gold remains safe and secure is an expensive task.

There are traders out there that avoid physical gold due to the risk of exposure to high-risk investments like gold stocks or ETFS. But, if your reason for investing gold is to shield your investments from potentially massive changes in the market, then you should consider investing in physical gold.

As such, out of all the different gold trading options out there, the value of gold has the most stable performance across several markets and maintains the same even in massive economic upheavals.

Fortunately, there are quite a number of online gold bullion traders to choose from. The most recommended of these is BullionVault.com (https://www.bullionvault.com/) which has access to several trading markets around the world while also providing manageable costs for the storage, selling, and buying of gold and other precious commodities.

For beginners, there are two things to consider when looking for bullion brokers or dealers:

Credibility - It goes without saying that, as a would-be buyer, you have to be duly diligent in determining whether that trader is trustworthy or not. Look for a trader with a spotless track record. Customers would also provide feedback but just remember that not all customer experiences are universal. Some would have positive comments, others less so. Either way, make sure that that broker has more positive reviews from customers than negative ones.

Pricing - A good dealer always charges for their commodities equitably. This means that the final gold price to customer might be different from trader to trader but the difference is not so wide a gap to cast doubt. In essence, physical gold has a comparatively less-dynamic pricing while futures, ETFs, and options tend to fluctuate from time to time.

Traditionally, the gold price is quoted and based in US dollars. Several platforms now offer the ability to purchase gold bullion and coins in several other currencies too such as sterling and euro. This adds another angle to the equation as for example you could purchase your gold in currency that has gotten stronger to the US dollar.

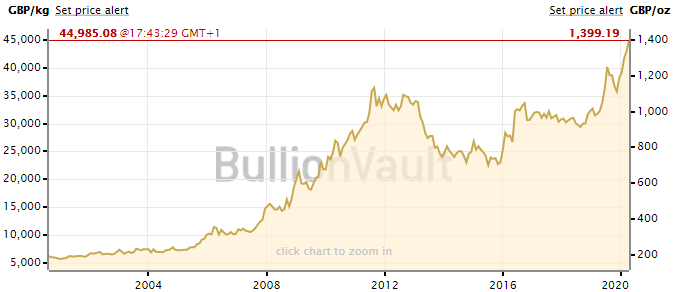

The chart above shows the gold bar price UK for the last 20 years, effectively it is the usual gold price in $/oz with a USD to GBP currency conversion added on top. With the pound getting stronger you can see the gold price in pounds is at its strongest it has ever been in the past 20 years.

Yet, in the same period chart but in US dollars you can see in the past twenty years there were already highs around 2012.

Buying and Trading Tips

Your strategy for buying and trading gold will be different from others. However, it would be best that you know which strategies have worked for successful traders. Here are some of them:

1. Mind the Yen

Out of all the currencies out there, it is the Japanese Yen that has enjoyed the highest possible correlation to gold. As a matter of fact, the price of gold in yen over the last 20 years has always been stronger than dollar-priced ones.

The most logical explanation to this is that gold and yen are perceived by the rest of the world as relatively safe investment options. Aside from that, the USD/JPY currency pair are dependent on real interest rates and speculations as to where they are headed which, as of currently, remains fairly strong in the country.

As such, if you want to know if the gold price in your country will be favorable for you, look at the strength of the Japanese Yen compared to other currencies. A stable yen trend for even two quarters of the fiscal year is a strong indication that perhaps the time is right to start investing in gold.

2. Look at the Gold/Silver Spread

Spreading is a common tactic in trading where you speculate not based on the performance of one commodity but two or multiple correlated ones. For gold, there is no stronger-related metal out there than silver.

Both gold and silver have been considered as viable investment options although silver is the more commercially flexible one. As such, traders have come up with strategies based on the spread of gold and silver in the market. In practice, if silver is performing rather well in the market, then the gold bar price in the UK will be favorable for traders.

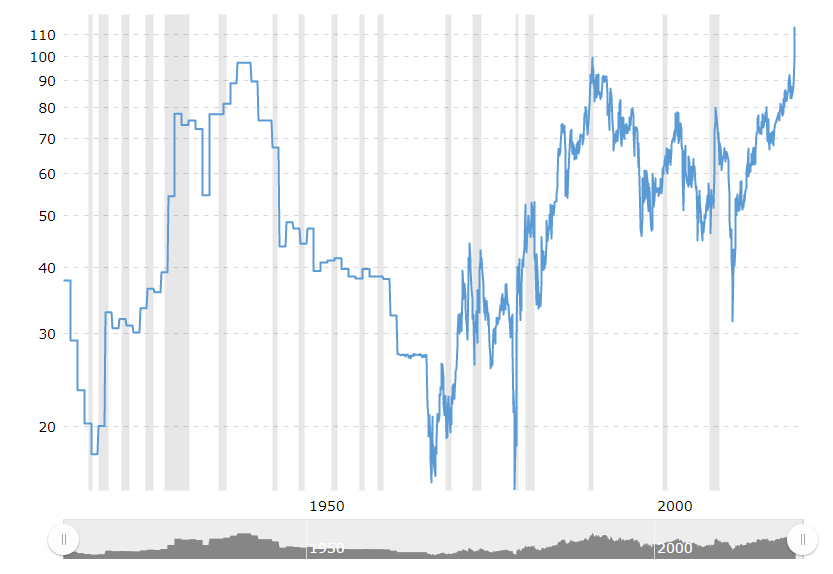

The chart above shows a 100 year historical chart for the Gold to Silver ratio. You can see it has gone past 110. It has never gone that extreme and the last time it even tried to reach the 100’s was early 1990’s when George Soros broker the Bank the England. The other time was around 1940 which was the time of World war 2.

But, just as with the Yen-Gold trading strategy, there is no guarantee that gold and silver will perform strongly together in the future as they did in the past

3. Pairs Against Stock

One neat strategy used by some is to trade gold bars in pairs against available gold stocks. This strategy is based on the fact that there is a strong historical relationship between the prices of gold stocks and actual gold.

The concept is that gold stocks are leveraged in a way to be positively correlated to physical gold. This correlation is even true for companies that do not stock or physically move gold and yet trade them. Before doing this strategy, however, it is better for you to check on several popular gold indexes like the Philadelphia Gold and Silver Index and the AMEX Gold BUGS Index.

4. Invest for the Long Term

Although a fairly stable commodity, Gold is not without its moments of volatility. As such, there are times when the price of gold will swing violently in response to sudden changes in the global economic and political events.

At the same time, however, the metal has a history of strength and stability. Either way, it is best that you pay attention to support for your gold investments and for ideas as to where the gold industry will be heading next.

Final Words

So, how much of your investments in your portfolio should focus in gold? What you have to remember is that your reasons for investing will dictate what kind of gold you want to invest on.

Gold bars are best if you want to put a hedge over your investments in case of economical and political instability. Thus, for investors in gold bars, the percentage should not be at least 5% but no more than 10%.

Gold coins is another cheaper entry into the world of gold investment. For around four hundred pounds you could pickup gold sovereigns, Around £1,400 can get you a 1 ounce gold coins. This could be an ideal way to save slowly but surely.

This should be enough to diversify your portfolio while giving your portfolio enough of a stability regardless of the current value of gold. On the flip side, the percentage is enough to not over expose your portfolio to gold to the point it becomes reliant on the precious metal. After all, you would rather not be put in a serious disadvantage in case the worst comes.

Aside from this, you should find a trading platform that does help you make the best possible decisions in trading and investing on gold bars. Sites like BullionVault.com do provide you with the most recent information regarding rends for gold investments across the world while also helping you get in contact with other traders.

After all, you would rather make sure that all of your investment decisions are well-informed especially in high-risk commodities. If you are ready to start on your gold bar trading experience, click here.